Article

Medicare Advantage Growth Will Bring Changes for Cancer Drug Manufacturers

April 27, 2023Authors

Topics

Changes to Medicare, including Medicare Advantage, have important repercussions on patient access to care, oncologists’ treatment decisions, and drug manufacturers’ processes.

Medicare changes are important for cancer drug manufacturers as approximately 60% of newly diagnosed patients will be covered by the program. Medicare has traditionally covered nearly all cancer treatments for US Food and Drug Administration indications and for indications with a National Comprehensive Cancer Network level 1 or 2 rating; however, while ultimate coverage may remain comprehensive, changes in types of coverage will inevitably complicate oncologists’ treatment decision-making and patients’ access.

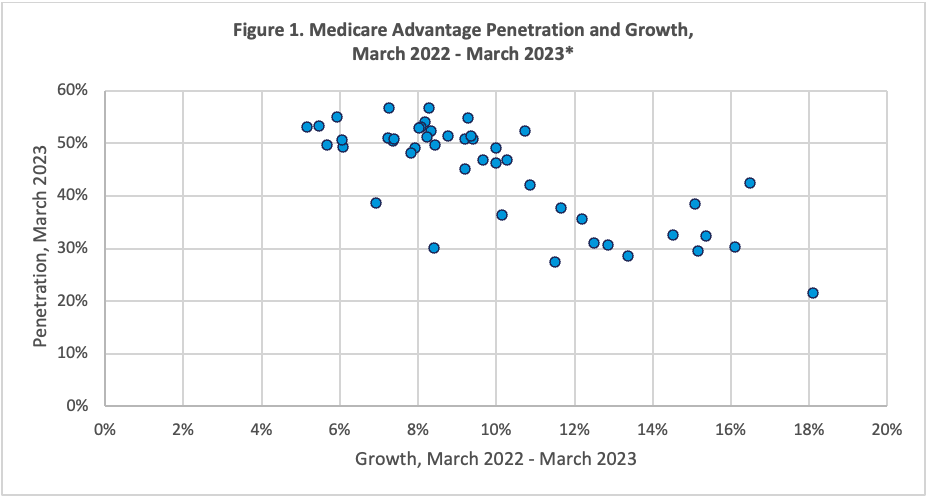

The continued growth of Medicare Advantage (MA) represents an immediate and frequently impactful change to cancer care. The program’s share of Medicare lives has risen substantially in recent years; even states with high penetration experienced growth of 5% or more between 2022 and 2023 (Figure 1).

Source: Centers for Medicare & Medicaid Services. Monthly Enrollment by State 2023 03. Accessed April 25, 2023. https://www.cms.gov/research-statistics-data-and-systems/statistics-trends-and-reports/mcradvpartdenroldata/monthly/monthly-enrollment-state-2023-03

*North and South Dakota, Wyoming, and Alaska were excluded due to very low penetration.

Multiple factors suggest that many health insurers will continue to seek growth in the MA market:

- Health insurers find that converting traditional Medicare beneficiaries to MA, and recruiting newly eligible beneficiaries, is less price competitive than seeking growth for commercial lives in head-to-head bidding wars.

- Seniors are attracted by the additional benefits many plans offer, which frequently includes at least vestigial dental and vision care.

- Beneficiary premiums and cost sharing appear to be low for many in-network services and are capped with annual out-of-pocket maximums, unlike traditional Medicare.

- MA margins remain higher than those for other markets in health insurers’ business books.

- The Kaiser Family Foundation found that the average annual margin per MA enrollee was $1,608/year compared to a commercial enrollee at $855/year from 2016 to 2018.

- MedPac estimated that in 2021, the average MA enrollee cost the Centers for Medicare & Medicaid Services (CMS) ~6% more than seniors enrolled in traditional Medicare. MedPac estimates that this differential raised overall Medicare program costs by $27 billion/year. Since then, aggressive acuity coding practices, quality bonuses, and steadily rising benchmarks suggest that profitability has improved even further.

MA disrupts “business as usual” for all stakeholders in three ways:

- Insurers cannot refuse coverage for most cancer drugs but can implement medication management strategies, including prior authorization (PA), step therapies, and clinical pathways with compliance incentives. These strategies complicate oncologists’ decision processes as the additional steps consume provider staff time and delay treatment even when PAs are approved. Insurers’ recent pledges to improve their PA processes may shorten delays but are unlikely to substantially reduce provider burden.

- Enrollment is increasingly concentrated, with United, Humana, and CVS/Aetna controlling as much as 58% of the senior market. This large market share provides operational economies of scale and negotiating leverage against providers and manufacturers.

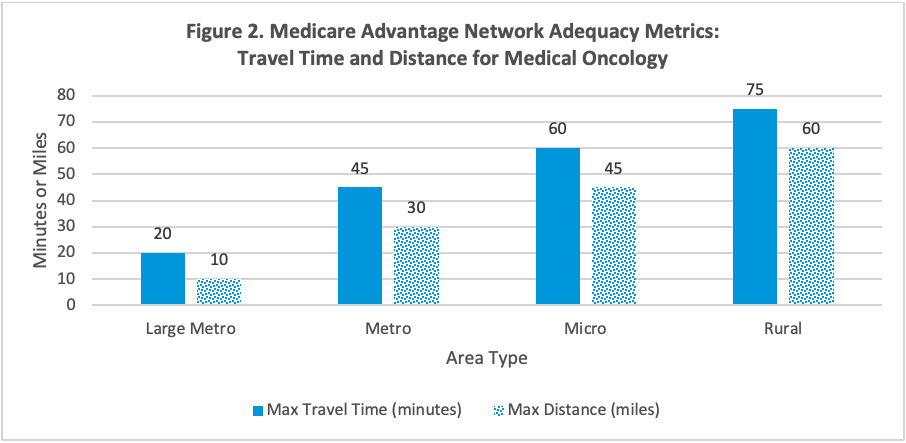

- Networks will channel patient referrals around “nonpreferred” oncologists. CMS affords plans wide latitude in their definitions of network adequacy for oncology and other specialties; in metro areas, an insurer’s network is only required to provide access to a medical oncologist within 30 miles or 45 minutes travel time of at least one beneficiary. This lax definition provides insurers with the opportunity to channel patients with cancer to a narrow set of providers; patients signing up for health maintenance organization (HMO) options will need to gain authorization to see out-of-network providers at higher costs, and those with preferred provider organization (PPO) plans will face both higher out-of-pocket costs and, potentially, oncologists unwilling to accept their coverage. Figure 2 provides an overview of network adequacy requirements for oncology.

Source: Cornell Law School Legal Information Institute. 42 CFR § 422.116 - Network adequacy. Published April 12, 2023. Accessed April 25, 2023. https://www.law.cornell.edu/cfr/text/42/422.116

Implications for Manufacturers

Manufacturers’ payer relations are increasingly important as commercial insurers extend their reach to growing numbers of seniors where cancer is most prevalent. Although coverage is still subject to Medicare policy, insurers’ implementation includes PA, step therapy, and differential out-of-pocket costs. Optimizing access will require active engagement and, in many cases, contracting.

MA networks may exclude leading cancer providers in many markets. Manufacturers can expect referrals and patient volume to decline in practices excluded from major payers’ networks. Channeling will increase patient volumes, and value to manufacturers, of those oncology groups willing to accept insurers’ terms. These terms may include compliance with relatively strict medical management processes featuring pathways, guidelines, and step therapies.

The Latest

Article

Notes From ATOPP: Providing Bispecific Antibody Treatments in Community Oncology

The ATOPP Summit covered a range of cutting-edge topics, including the shift toward administering cellular therapies to patients in community oncology settings.

Emma Bijesse, Daniel BuchenbergerArticle

Oncology Clinics Frustrated With Manufacturer Engagement Tactics

Welcome to the June 2024 edition of our Monthly Insight Series! This month we’re discussing oncology clinic concerns with existing manufacturer engagement approaches, using data drawn from our 2024 Community Oncology report, coming later in June.

Ashutosh ShethArticle

When Do Payer Pathways Matter?

While provider-initiated oncology clinical pathways are regaining momentum, payer pathways struggle to find a foothold in this space. Still, they can exert impact under certain conditions.

Cindy Chen