Article

Humana Quits Commercial

March 22, 2023Authors

Topics

Welcome to the March 2023 edition of our Monthly Insight Series. This month we discuss how Humana terminated its employer group line of business and the implications.

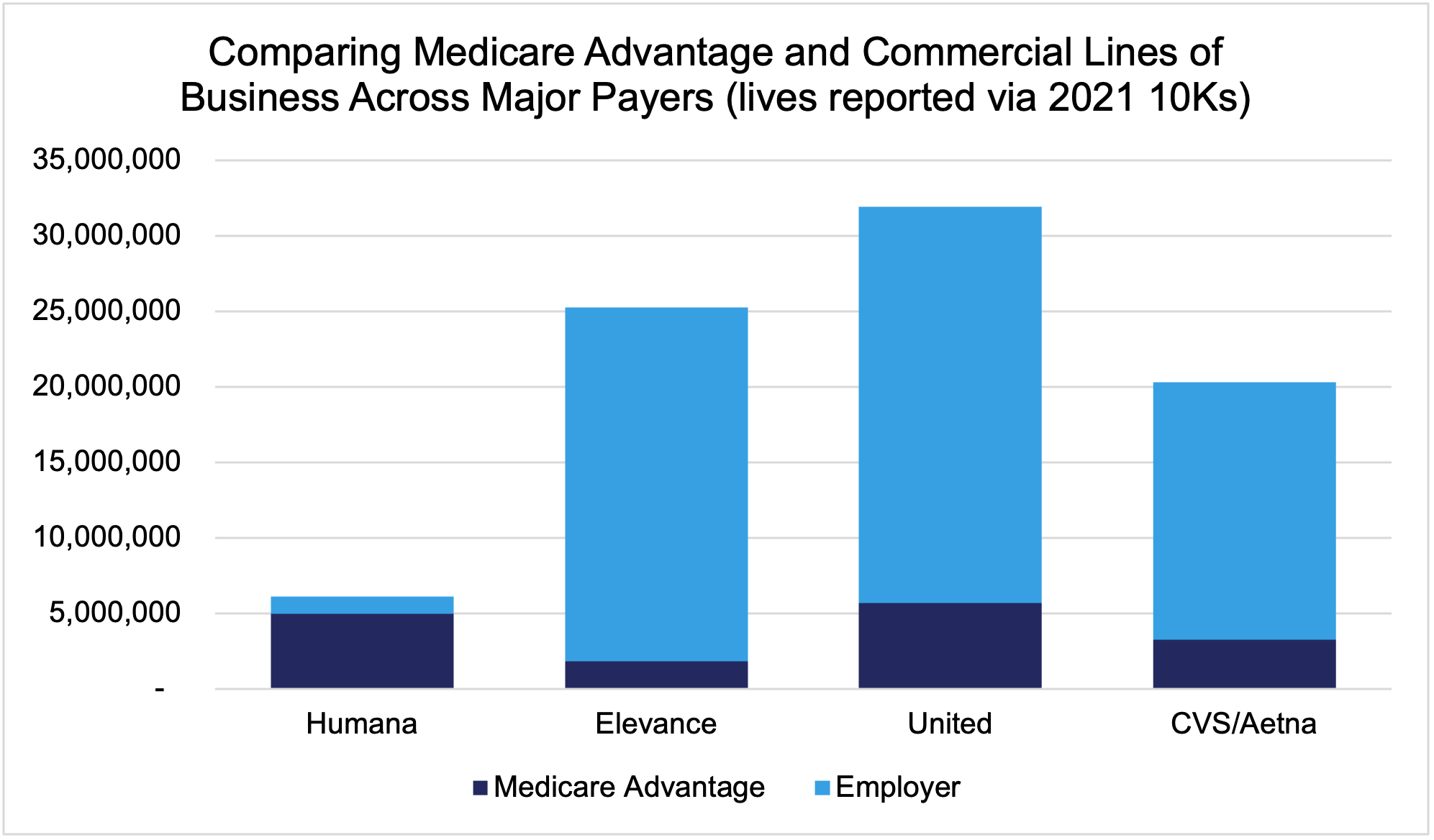

Humana recently announced that it will terminate its employer group line of business. This may make sense for Humana for two reasons: government programs currently provide a much higher ROI compared to commercial/employer business, and the company enjoys a strong Medicare Advantage (MA) market position (second only to United Healthcare Group) but has suffered from low market share in its commercial lines. By 2021, commercial lives contributed only 6% of the company’s revenue.

Humana By the Numbers

- “Per capita” premium revenue is ~3.6x higher for its Medicare Advantage members versus its commercial/employer lives

- Medical loss ratio is similar between its overall government business and its overall Group & Special business (~88% and ~83%, respectively); given the higher per capita premium, this means a higher gross margin for Humana

- Operating Cost Ratio is ~60% less on the government side, again suggesting higher margins

- Based on membership volumes and the premiums received, Humana’s government program total earnings are 13x higher than those for its commercial/employer business

Expanding commercial volume inevitably requires stealing share from other insurers, while Medicare Advantage also offers the opportunity to convert fee-for-service Medicare lives to Medicare Advantage. However, by putting most of its eggs in one basket (Medicare Advantage), Humana increases its vulnerability to potential legislative changes to the program that may reduce the financial attractions. For example, CMS’ 2024 Advance Notice might reduce Medicare Advantage spending by an average of $540 per Medicare Advantage enrollee.

All our best...

-- HMP Market Access Insights Team

The Latest

Article

Notes From ATOPP: Providing Bispecific Antibody Treatments in Community Oncology

The ATOPP Summit covered a range of cutting-edge topics, including the shift toward administering cellular therapies to patients in community oncology settings.

Emma Bijesse, Daniel BuchenbergerArticle

Oncology Clinics Frustrated With Manufacturer Engagement Tactics

Welcome to the June 2024 edition of our Monthly Insight Series! This month we’re discussing oncology clinic concerns with existing manufacturer engagement approaches, using data drawn from our 2024 Community Oncology report, coming later in June.

Ashutosh ShethArticle

When Do Payer Pathways Matter?

While provider-initiated oncology clinical pathways are regaining momentum, payer pathways struggle to find a foothold in this space. Still, they can exert impact under certain conditions.

Cindy Chen