Article

Routine Access for Cancer Drugs in IDNs: More Than Just a Click Away

May 12, 2022Authors

Topics

Welcome to the May edition of our Monthly Insight Series. MAI conducts a Brand Survey as part of our annual IDN Trend Survey. For 2022, we continued this tradition as we set out to understand the prescribing burden for IDN oncologists.

Greetings from San Mateo!

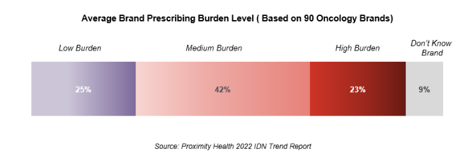

Our sponsors know that HMP Global Market Access Insights (MAI) conducts a Brand Survey as part of our annual IDN Trend Survey. For 2022, we continued this tradition as we set out to understand the prescribing burden for IDN oncologists, across 10 tumor types and 90 brands.

MAI defines “routine access” as the condition in which a cancer drug is available for ordering through an EMR with no additional work on the doctors’ part beyond selecting a regimen or order set. We queried 138 oncology pharmacists based on our definition of “routine access” to ordering drugs in EHR, defined as:

Low Prescribing Burden: where an Rx order receives routine review or approval. This constitutes “routine access”

Medium Prescribing Burden: where an Rx order is likely to trigger utilization or clinical guideline review with some justification required, although that justification may be automated

High Prescribing Burden: where an Rx order may include a highly restrictive internal approval process, or compliance with a restrictive pathway, and/or an individual review for each patient

The Results

An average oncology brand is subjected to low prescribing burden, or “routine access,” for 25% of the providers. The burden placed on a particular brand varied across providers from different institutions.

Conversely, an average brand is subjected to high prescribing burden for 23% of providers. High prescribing burden level is generally consistent across the 10 tumor types queried: NHL is the disease area in which the highest average prescribing burden level is reported, triggered by multiple CAR-T treatments

Given the variety of brands surveyed, some respondents are not familiar with certain brands and the respective access.

For more information on prescribing burden for individual brands, and the clinical controls and strategies employed by IDNs, stay tuned for our sponsor report presentations in May and June.

As always, please reach out with any comments and questions you may have.

All the best...

-- HMP Market Access Insights Team

The Latest

Article

Notes From ATOPP: Providing Bispecific Antibody Treatments in Community Oncology

The ATOPP Summit covered a range of cutting-edge topics, including the shift toward administering cellular therapies to patients in community oncology settings.

Emma Bijesse, Daniel BuchenbergerArticle

Oncology Clinics Frustrated With Manufacturer Engagement Tactics

Welcome to the June 2024 edition of our Monthly Insight Series! This month we’re discussing oncology clinic concerns with existing manufacturer engagement approaches, using data drawn from our 2024 Community Oncology report, coming later in June.

Ashutosh ShethArticle

When Do Payer Pathways Matter?

While provider-initiated oncology clinical pathways are regaining momentum, payer pathways struggle to find a foothold in this space. Still, they can exert impact under certain conditions.

Cindy Chen