Article

Clinical Pathways Impact on Treatment Selection

June 21, 2023Authors

Topics

As more providers explore clinical pathways as a tool for increasing clinical consistency and quality, we need to examine adoption benefits and challenges, provider compliance, and potential access risks for manufacturers.

MAI’s current provider and payer research delineates the multilayered complexity of pathways. Many payers, highly integrated delivery networks (IDNs), and the largest community oncology medical networks have implemented pathway programs. Pathway compliance and incentives for compliance vary widely within these programs. At the same time, many oncology providers remain unaware of pathways but are marked as “compliant” when their treatment selections happen to match a pathway’s guidance (ie, unconscious compliance).

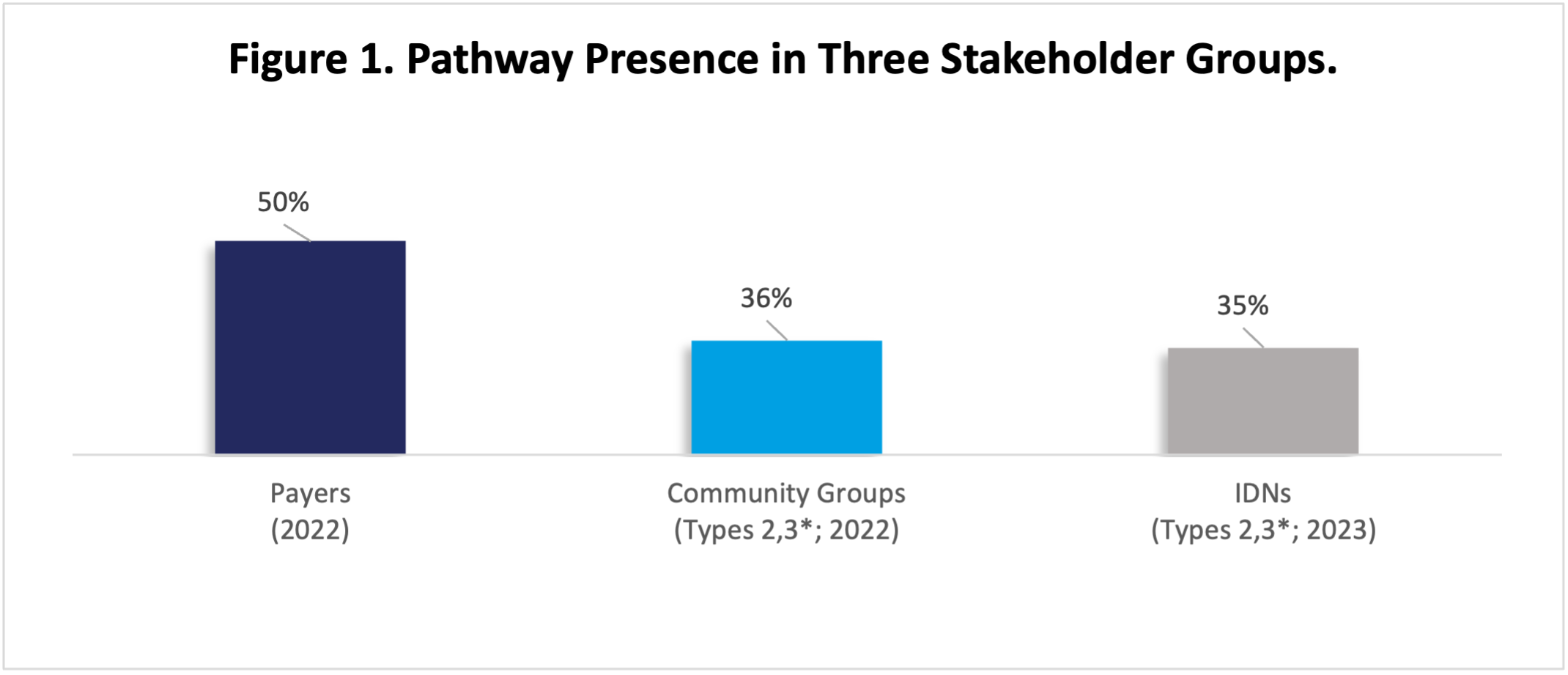

Manufacturers must understand the realities of oncology pathways’ role and impact in the US market. Figure 1 shows the percentage of leading IDNs, sophisticated community oncology groups, and payers that report having oncology pathway programs.

Source: Oncology Customer Insights, HMP Market Access Insights, 2022, 2023.

*Types 2,3 refers to two of the three archetypes assigned across community groups and IDNs: Type 1, Type 2, and Type 3, with Type 3 including the highest-performing practices.

Abbreviation: IDNs, integrated delivery networks.

Toward Understanding Pathway Impact: Why Providers Follow Pathways

Oncology clinical pathways help provider organizations pursue internal goals, including improving quality and patient satisfaction, and reduce operational and logistical costs. Pathway programs achieve this in several ways:

- Improving quality: A restrictive pathway provides oncologists with 1 to 3 “best” options for patients requiring treatment. Following the guidance is usually not mandatory but helps a busy oncologist ensure that the patient benefits by receiving a treatment selected by a consensus of experts (in most programs) who’ve assessed the options and selected the most appropriate treatments.

- Ensuring consistent quality: Adopting pathways across a network helps ensure that patients receive consistent care regardless of which site they are treated in. This helps organizations build brand value and leverage internal disease experts who specialize in particular tumors.

- Improving networks’ operational efficiency: Pathways can help networks reduce prescribing variation. Reducing variation decreases the number of order sets used to treat patients, which improves nurses’ and pharmacists’ familiarity with mixing, dosing, pre-meds, and other clinical and logistical tasks. Narrowing variation helps reduce errors that arise from unfamiliarity with an order set and/or its associated therapeutic, and it simplifies stocking and scheduling.

- Saving physicians’ time: Pathways save physicians the time needed to “get up to speed” on new developments. A trusted pathway saves a busy oncologist from reviewing and comparing other information sources to inform a treatment selection.

Toward Understanding Pathway Impact: What Goes Wrong?

- Developing and maintaining clinical pathways: This represents a large investment for providers and external developers. New product launches, real-world evidence, and data updates mean that pathways must be updated regularly to reflect improving standards of care.

- Failing to communicate clinical value to physicians: Most programs do not provide clear value proposition or guidance without interrupting oncologists’ prescribing workflow. Payer pathways can be particularly ineffective at communication, as many oncologists learn of a pathway’s existence only through denied prior authorizations (PAs).

- Resisting adoption of pathways: Certain oncologists are reluctant to adopt pathways, seeing them as a curb on clinical freedom. Effective programs emphasize transparency in their assessment processes and create avenues to accommodate patients with rare tumors or comorbidities that preclude using a pathway.

- Monitoring and evaluating pathways after implementation: Once a pathway is being used, it must be constantly monitored for both compliance and the impact on other program goals, including clinical and financial outcomes. Programs can fail to monitor any metrics beyond apparent compliance.

Low Awareness Obscures Pathways’ Impact Through Unconscious Compliance

“Unconscious compliance” may exert a training effect on oncologists. Oncologists frequently select treatments without being aware their choice matches their practice’s pathway. This arises whenever broader pathways closely match National Comprehensive Cancer Network (NCCN) and US Food and Drug Administration (FDA) labels. This is particularly true where few alternatives exist for a specific combination of tumor/biomarker/line of therapy.

MAI’s research shows that fewer than half of community oncologists and IDN oncology pharmacists consciously consult pathways, even in regions where payer programs are implemented. Many oncologists gain awareness only when a PA is denied; over time, denials lead physicians to select therapies that can be successfully authorized, and the doctor remains unaware of the pathway impacting the selection.

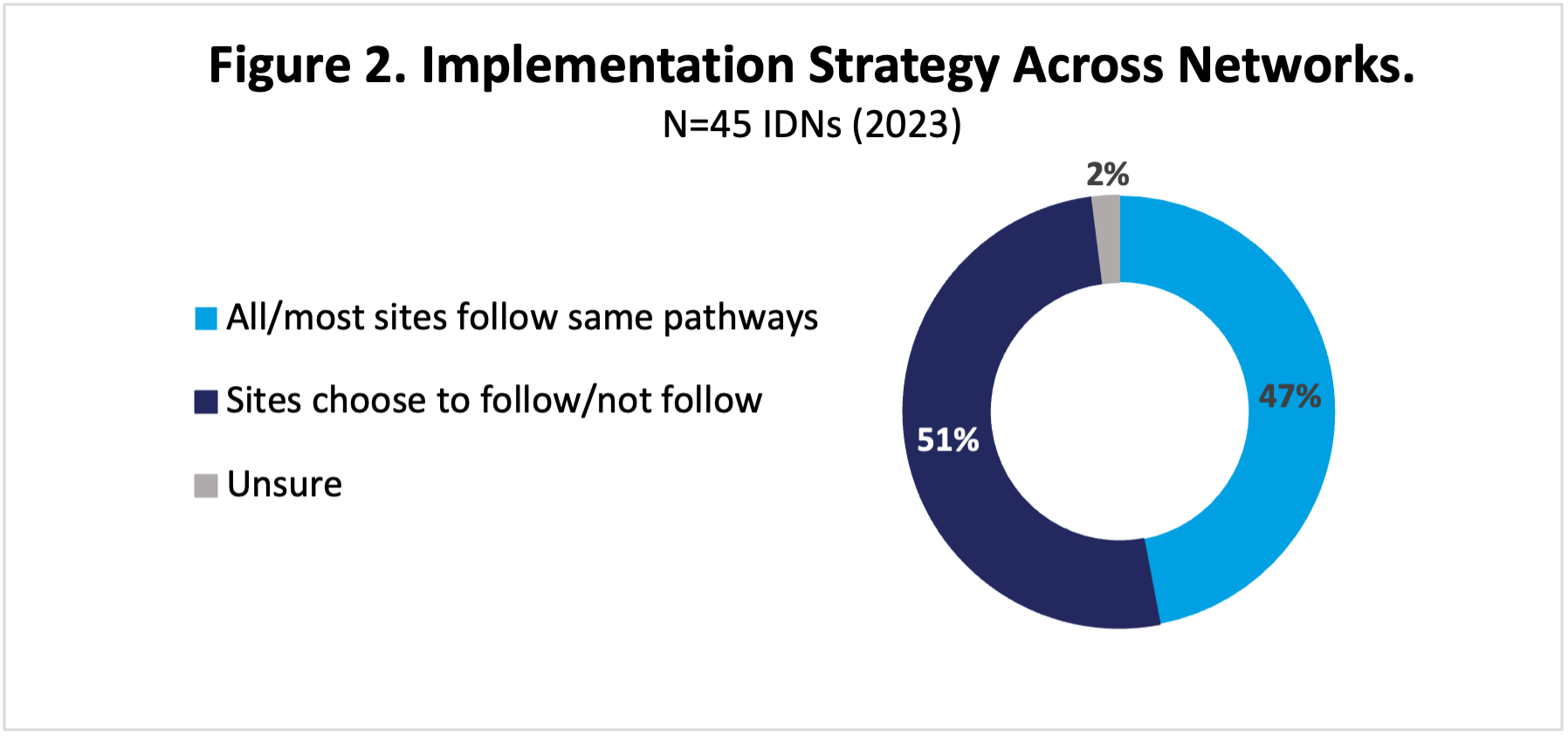

Provider pathways may not be evenly implemented across networks. Most (78%) of our highly integrated IDNs have programs, but not all 45 institutions with pathways in our 2023 research have implemented the programs across their entire networks (Figure 2). The remainder are either still in the process of rollout or allow certain sites or regions to not participate. This may be due to differences in the “payer mix” at each site across the network, or inconsistent IT systems. The largest, most sophisticated community groups (eg, OneOncology, American Oncology Network, and the US Oncology Network) have implemented their programs in most or all groups, although compliance can vary.

Abbreviation: IDNs, integrated delivery networks.

Payer pathway programs tend to feature “carrots” not “sticks.” Most national and regional health insurers have a program in place run either by an internal group (eg, Optum and Carelon) or by an external organization (eg, New Century Health or Evicore). Compliance with payer pathways is typically voluntary, and although some—for instance, Humana—provide incentives for compliance, many offer rapid PA for on-pathway treatment selections. Physicians may not be aware of a pathway even in situations where an off-pathway choice is approved, as the payer may not inform the doctor of the pathway. Denials and speedy approvals, however, tend to “train” oncologists to pick therapies that are approved easily.

Pathways Present a Risk to Manufacturers

Oncology clinical pathways clearly represent a potential risk to product adoption and access in a large segment of US oncology providers, as brands excluded from pathways face adoption hurdles.

Compliance with IDN and oncology groups’ pathways is frequently mandatory and monitored; products on a pathway will gain most of the volume from affiliated and employed oncologists. Prescribing off pathway may require oncologists to defend their selection to a managerial oncology pharmacist or physician; even if the choice is ultimately approved, the delay in treatment and burden on the oncologist dissuades frequent excursions.

While payer pathways may be harder to assess, manufacturers should be alert for “training effects” where an oncologist learns by trial and error that a particular alternative is easily approved while others require additional documentation or appealing a PA denial. Over time, the oncologist is likely to adopt the payer’s preference and may well begin to prescribe this choice consistently across all appropriate patients.

Stay tuned for new and expanding insights on oncology pathways this summer and fall as our pathway studies begin to report out!

The Latest

Article

IDN Financial Incentives: Impact on Treatment Prices?

Navigating IDNs requires understanding their financial drivers, revenue streams, and cost management. Here, we look at IDNs' key financial aspects, such as revenue optimization strategies, and examine the potential effects of site-neutral payment reforms.

Emma BijesseArticle

Provider Economics Drive Oncologist Consolidation

Welcome to the March 2024 edition of our Monthly Insight Series. This month we examine the trend of oncologists consolidating into IDNs and network aggregators.

Taylor CrutisonArticle

An Update on What You Need to Know About Pathways

Welcome to the February 2024 edition of our Monthly Insight Series, featuring key findings from our recent column in the Journal of Clinical Pathways. The column was the first in a series on oncologists' awareness and use of pathways.

Lee Blansett