Article

Provider Economics Drive Oncologist Consolidation

March 08, 2024Authors

Topics

Welcome to the March 2024 edition of our Monthly Insight Series. This month we examine the trend of oncologists consolidating into IDNs and network aggregators.

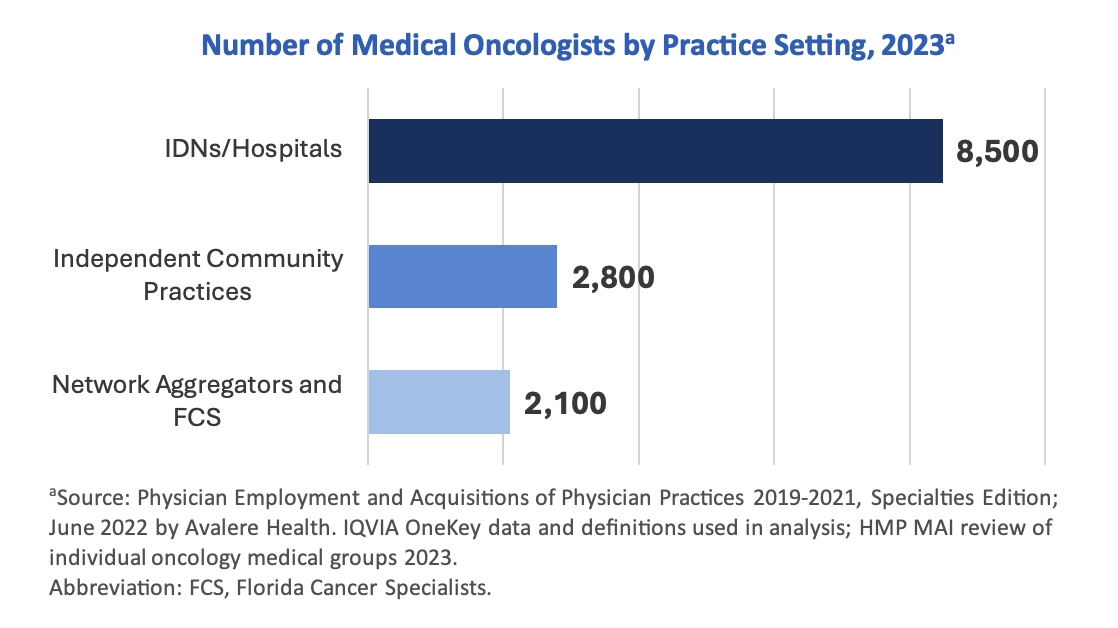

Most oncologists now practice in either an integrated delivery network (IDN) or in a sophisticated medical group within a network of community practices. Declining economics drove this consolidation as larger entities with economic scale and bargaining power against suppliers and payers acquired practices and hired individual oncologists. Consequently, only 1 in 5 oncologists now practice in an independent community setting. The figure below illustrates the types of organizations where medical oncologists now practice.

- IDNs/hospitals employ most medical oncologists: More than 60% of medical oncologists are employed in an IDN or hospital setting, providing them with quality-of-life benefits and a (more or less) stable financial status. As IDNs grow their oncology service lines, they represent an increasing threat to community practices – more than half of practices in our 2023 Community Oncology Survey cited IDNs as their major source of competition for referrals.

- Oncology “network aggregators” are rapidly increasing in size: These aggregators, or large networks of community practices, have grown rapidly over the past 2-3 years and now employ nearly half of the oncologists remaining in community settings. Many aggregators are focusing on expanding their networks, and their numbers are expected to surpass that of independent community practices in the next few years.

- Independent community oncology practices can still be lucrative: Our upcoming landscape report dives into exclusive data on community practices’ revenues and expenses and illustrates independent groups’ economic realities, including the upsides. Practices that understand their competitive landscape and actively make strategic decisions to improve their positioning and revenue streams see the most success. Those that are operated as sophisticated businesses and look to gain economies of scale, including expansion through acquisitions in their market or contiguous markets, will remain competitive.

The Latest

Article

Notes From ATOPP: Providing Bispecific Antibody Treatments in Community Oncology

The ATOPP Summit covered a range of cutting-edge topics, including the shift toward administering cellular therapies to patients in community oncology settings.

Emma Bijesse, Daniel BuchenbergerArticle

Oncology Clinics Frustrated With Manufacturer Engagement Tactics

Welcome to the June 2024 edition of our Monthly Insight Series! This month we’re discussing oncology clinic concerns with existing manufacturer engagement approaches, using data drawn from our 2024 Community Oncology report, coming later in June.

Ashutosh ShethArticle

When Do Payer Pathways Matter?

While provider-initiated oncology clinical pathways are regaining momentum, payer pathways struggle to find a foothold in this space. Still, they can exert impact under certain conditions.

Cindy Chen