Article

HMP Global Market Access Insights’ 2023 Research Year

February 16, 2023Authors

Topics

We want to give you a look at some of the topics we’re planning to explore this year, as we enter yet another period of rapid change, upheaval, and uncertainty in 2023-2025.

Welcome to HMP MAI’s 2023 research year!

We want to give you a look at some of the topics we’re planning to explore this year, as we enter yet another period of rapid change, upheaval, and uncertainty in 2023-2025.

Here’s our take on three well-established trends we expect to continue. These changes require taking a hard look at your health care provider and payer engagement strategies for 2023 and 2024.

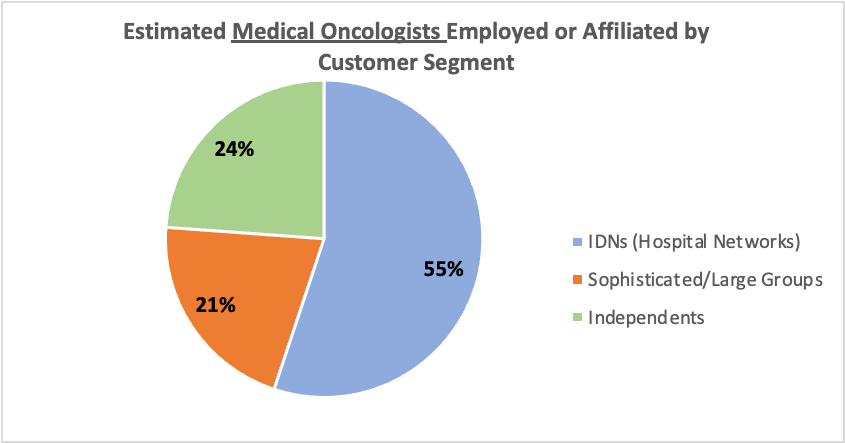

Oncologists continue to consolidate into larger groups and networks. We estimate that approximately 55% of medical oncologists currently work with IDNs, while another 20-21% are employed within US Oncology, OneOncology, AON, or a sophisticated independent group tied to QCCA or NCCA. We estimate that just 24% of oncologists still practice in the traditional small group segment with little or no internal medical management infrastructure.

*Estimates based on HMP MAI analysis of Magellan 2018 report, individual community oncology group data, ASCO practice survey

- Oncologists employed in IDNs and bruiser groups are subject to centralized influence through EHRs that communicate guidelines, pathways, and other guidance on prescribing. Engaging these physicians requires working with the committees and medication managers who develop and disseminate this guidance. Clinical data carries the highest weight, but the committees also consider business topics, including provider economics.

- Oncologists working in smaller, independent groups have higher levels of prescribing autonomy. These oncologists are frequently open to engagement through traditional strategies deploying sales reps and MSLs. Efficacy and safety data have the most substantial influence on these MDs’ treatment selections.

CMS and commercial payers seek to reduce prices for all goods and services delivered to cancer patients

- MAI’s payer research in 2022 showed that commercial payers expect to increase their brand rebate, administrate, and data fee levels for all books of business in 2023-25. Discussions with providers suggest that reimbursement is also under pressure as payers try to implement networks focusing on low cost and adequate quality but with high levels of payer leverage.

- Brand teams with products in competitive classes and with close substitutes can assume that payers and (a few) providers will seek to compare relative clinical performance and cost using published data as they seek to reduce prescribing variation and cost.

Vertical payers are growing their roles in delivering and managing care, but strategies vary substantially.

- While CVS notably plans to pay $10 billion to buy primary care company Oak Street Health, others, including Cigna, prefer to use partnership approaches that extend their influence but at lower capital costs and less organizational complexity.

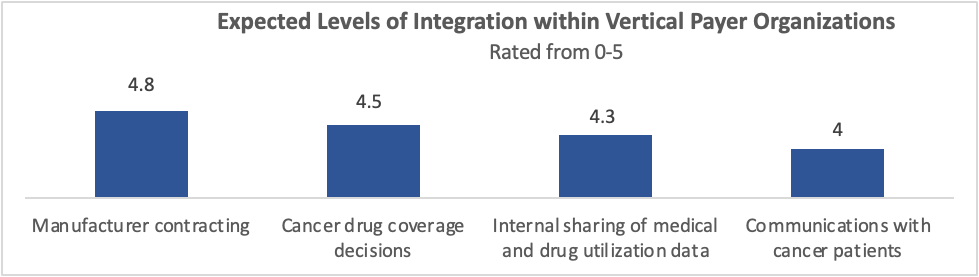

- Manufacturers need to consider these vertical payers both as integrated customers and as individual entities for the time being. MAI’s research shows that the organizations will work to coordinate internally and, within 2-3 years, try to present a single face to manufacturers to extract increased levels of financial concessions based upon their (highly theoretical) ability to further narrow MDs' treatment selections for large patient groups.

Check back in a few weeks for our next blog post that looks at several interesting wild cards for the 2023-2025 time period!

All the best...

-- HMP Market Access Insights Team

The Latest

Article

IDN Financial Incentives: Impact on Treatment Prices?

Navigating IDNs requires understanding their financial drivers, revenue streams, and cost management. Here, we look at IDNs' key financial aspects, such as revenue optimization strategies, and examine the potential effects of site-neutral payment reforms.

Emma BijesseArticle

Provider Economics Drive Oncologist Consolidation

Welcome to the March 2024 edition of our Monthly Insight Series. This month we examine the trend of oncologists consolidating into IDNs and network aggregators.

Taylor CrutisonArticle

An Update on What You Need to Know About Pathways

Welcome to the February 2024 edition of our Monthly Insight Series, featuring key findings from our recent column in the Journal of Clinical Pathways. The column was the first in a series on oncologists' awareness and use of pathways.

Lee Blansett