Article

Anticipating Changes in the Community Oncology Ecosystem Through 2025

March 22, 2023Authors

Topics

OneOncology’s $2 billion “for sale” sign is an important warning that the next 2 to 3 years will bring new, unpredictable shocks to the community oncology ecosystem as stakeholders grapple to assert control over the healthcare dollar.

OneOncology’s $2 billion “for sale” sign is an important warning that the next 2 to 3 years will bring new, unpredictable shocks to the community oncology ecosystem as stakeholders grapple to assert control over the healthcare dollar. New and ongoing pressure from changing Medicare reimbursement, increasing payer action, and the impact of federal drug pricing initiatives is leading many providers to ponder their futures.

While close to half of our community oncology survey participants are confident that they’ll remain independent or have already joined a “super group,” a substantial minority expect to be practicing in a different arrangement from their current one and are thinking about their options:

- 36% of our responding practices believe they’re likely to be acquired by a hospital or IDN

- 31% report being likely to merge with another local practice

- 21% report being likely to close their practice altogether

It’s important to note that these distressed practices were broadly representative of community practice overall. A few larger groups, including USON-affiliated practices, perceived a high likelihood of being acquired by an IDN or merging with another local practice. Those reporting a high likelihood of closure were generally smaller practices with declining patient volumes and referral channels that are highly dependent upon a small number of referring providers.

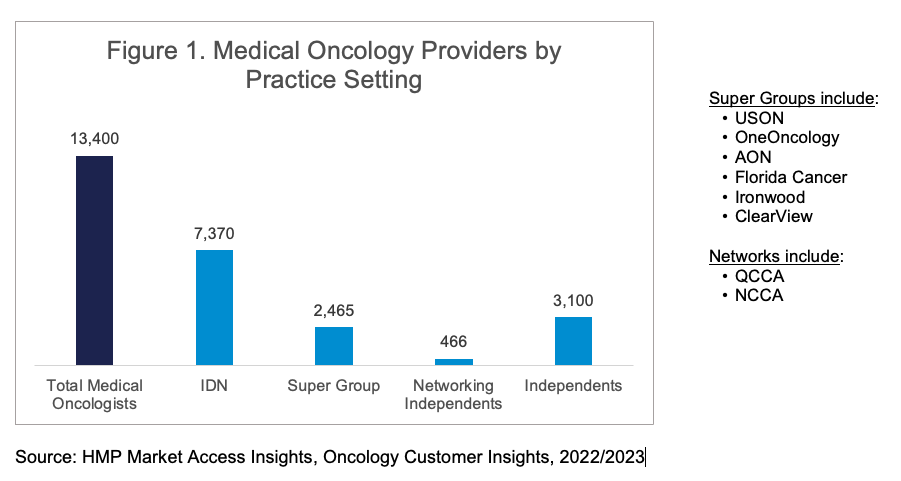

Oncology is already a highly consolidated specialty, with less than one-quarter of physicians practicing in the “traditional” small, independent practices that were common between 1990 and 2010. Figure 1 below illustrates that more than half of medical oncologists and hematologists/oncologists already practice in IDN organizations, either community hospital-based or academic medical center-based. Another approximately 22% practice in “super groups” including USON, AON, and others. A small number, approximately 30 to 35 groups, remain independent but seek scale benefits through aligning with QCCA or NCCA.

Key Takeaways for Manufacturers:

Manufacturers need to ensure that these changes are reflected in their relationship priorities. High-volume community practices will increasingly operate under a corporate framework such as USON or AON. Many truly independent groups are likely to either grow, as they seek to dominate their local markets for oncology services, or stagnate, with flat or declining patient referrals and shrinking market shares. Any community oncology practice hoping to thrive must become financially astute and operate efficiently.

Traditional promotional strategies focused on clinical messaging will only be effective with a shrinking number of oncologists; some groups restrict access to their physicians and internal medical management systems through pathways, formularies, and order sets, which influence oncologists’ personal choices when ordering treatment.

All the best...

-- HMP Market Access Insights Team

The Latest

Article

Bispecific Therapies in Community Oncology: Bridging Insights from CPC+CBEx and Beyond

Explore key takeaways from CPC+CBEx on bispecific therapies, highlighting collaboration between hospitals and community practices to expand access and tackle financial challenges.

Daniel BuchenbergerArticle

Community Oncology: Awareness v Action in the Face of the IRA

The Inflation Reduction Act (IRA) will significantly impact community oncology practice financials. As we approach this shift, our latest research from the 2024 Community Oncology Report reveals a current gap between awareness and action.

Emma BijessePrior Authorization Requirements Continue to Impact Providers

Welcome to the August 2024 edition of our Monthly Insight Series! This month we are combining insights from 3 of our customer segment reports and reflecting on provider and payer relationships.

Emma Bijesse