Article

Understanding HMP Global Market Access Insights' New Payer Report Series

March 10, 2022Authors

Topics

Welcome to the March edition of our Monthly Insight Series. This month we review several highlights from our December 2021 Special Topic Report on Payers.

Greetings From San Mateo!

Welcome to the March edition of our Monthly Insight Series. This month we review several highlights from our December 2021 Special Topic Report on Payers.

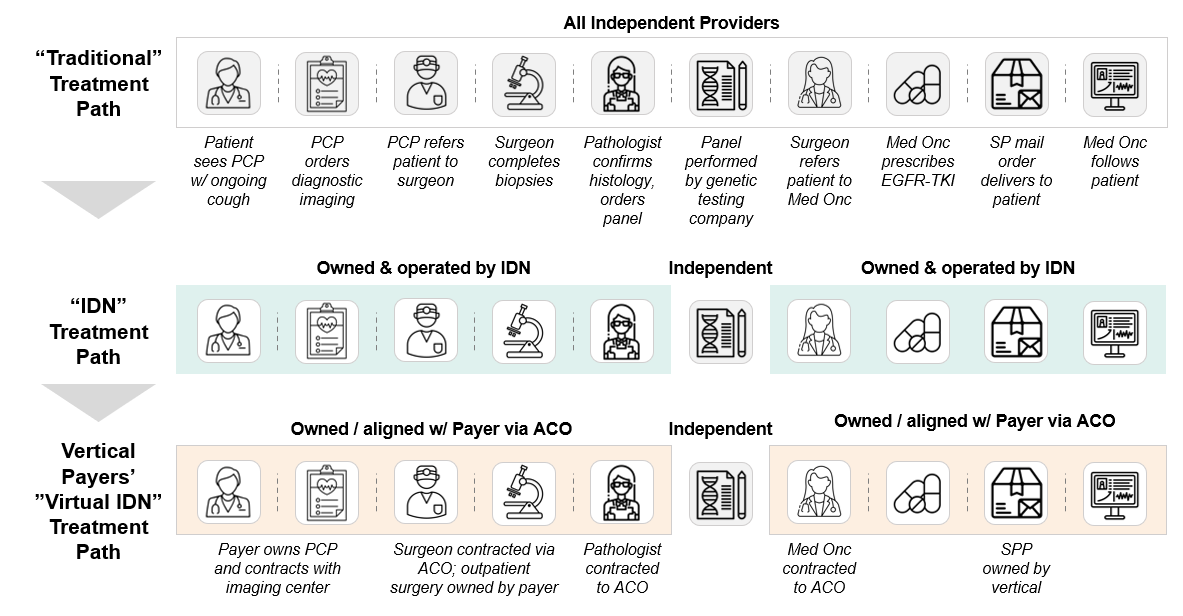

Why Payers? The insurance marketplace has become increasingly consolidated, and companies are looking for new avenues for growth. Large, horizontal mergers reached a standstill when the Cigna + Anthem merger was blocked by a U.S. district court resulting in a termination of the agreement. Payers are now focusing on vertical integration, and blurring the lines between insurer, PBM, SP, and Provider.

Payers are, in some cases, now acting as "virtual IDNs" enabling them to manage the initial referral and capture downstream revenues (see below).

Grappling With the (Payer) Octopus

We see several trends continuing to accelerate in this "Vertical Era":

1. Payers and Providers will increasingly compete to control patients. Expect provider consolidation as competition weeds out the weak. Monitor payer expansion from "easy" opportunities such as senior care into high-cost and high-complexity areas including oncology.

2. "Virtual First" plans become commonplace. Payers save money by asking patients to initiate care using a phone or video encounter. Patients are then directed to the insurers' preferred providers for subsequent care, subject to strict prescribing controls. These narrow specialty networks increase plans' influence on treatment selection.

3. Manufacturers will need to track their relationships and financial arrangements across an entire vertical payer organization. Vertical payers will inevitably have internal conflicts as priorities among subsidiaries vary, most likely between an insurer’s search for low total cost of care and a PBM’s search for rebates, admin, and data fees. Manufacturers should assess each vertical payer’s level of integration and adapt their commercial interactions to optimize their results across the entire payer vertical.

If you like what you see, stay tuned! We are planning to release a payer podcast this April. As always, please reach out with any questions or comments you may have.

All the best...

-- HMP Market Access Insights Team

The Latest

Article

IDN Financial Incentives: Impact on Treatment Prices?

Navigating IDNs requires understanding their financial drivers, revenue streams, and cost management. Here, we look at IDNs' key financial aspects, such as revenue optimization strategies, and examine the potential effects of site-neutral payment reforms.

Emma BijesseArticle

Provider Economics Drive Oncologist Consolidation

Welcome to the March 2024 edition of our Monthly Insight Series. This month we examine the trend of oncologists consolidating into IDNs and network aggregators.

Taylor CrutisonArticle

An Update on What You Need to Know About Pathways

Welcome to the February 2024 edition of our Monthly Insight Series, featuring key findings from our recent column in the Journal of Clinical Pathways. The column was the first in a series on oncologists' awareness and use of pathways.

Lee Blansett